Diving into the world of insurance claims process, get ready to uncover the secrets behind filing claims and getting what you deserve. From the initial stages to the final settlement, this rollercoaster ride will keep you on the edge of your seat.

Get ready to explore the different types of claims, the essential documents needed, and the crucial role of insurance adjusters in this thrilling journey through the insurance world.

Overview of Insurance Claims Process

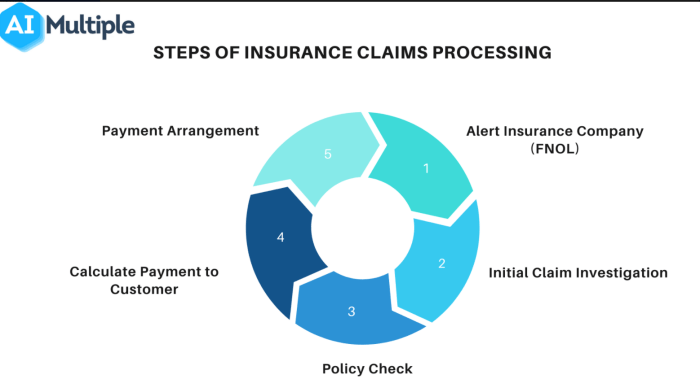

When it comes to the insurance claims process, it refers to the procedure that policyholders go through to request compensation from their insurance company for a covered loss or damage. This process is crucial for both insurers and policyholders as it ensures that claims are handled efficiently and fairly.

Key Stages in an Insurance Claim

- Reporting the Claim: The first step is to inform the insurance company about the loss or damage and provide all necessary details.

- Claim Investigation: The insurance company will investigate the claim to determine its validity and extent of coverage.

- Evaluation of Damages: A thorough assessment of the damages or losses will be conducted to determine the amount of compensation.

- Negotiation and Settlement: Both parties will negotiate the settlement amount, and once agreed upon, the claim will be settled.

- Payment: The insurance company will issue the payment to the policyholder according to the terms of the policy.

Importance of a Smooth Claims Process

A smooth claims process is essential for insurers as it helps them maintain customer satisfaction and trust. It also ensures that claims are processed efficiently, reducing the risk of fraud or delays. For policyholders, a smooth claims process means they can quickly recover from a loss or damage without facing unnecessary hurdles or delays, providing them with peace of mind and financial security.

Types of Insurance Claims

When it comes to insurance claims, there are several different types that individuals may encounter. Each type of insurance claim has its unique aspects and processes for handling. Let’s take a closer look at some common types of insurance claims.

Auto Insurance Claims

Auto insurance claims are filed when a vehicle is involved in an accident or sustains damage. The process typically involves collecting information from all parties involved, assessing the damage to the vehicle, and determining fault. Insurance adjusters will then work to settle the claim and cover the costs of repairs or replacement.

Health Insurance Claims, Insurance claims process

Health insurance claims are submitted when an individual seeks reimbursement for medical expenses. This can include doctor visits, prescriptions, surgeries, and other healthcare services. The process involves submitting documentation of the services rendered and the associated costs to the insurance company for review and payment.

Property Insurance Claims

Property insurance claims are made when a property, such as a home or business, is damaged or destroyed. This can be due to natural disasters, fires, theft, or other unforeseen events. The process includes documenting the damage, obtaining estimates for repairs or replacement, and working with the insurance company to reach a settlement.

Comparison of Insurance Claims

- Auto insurance claims often involve third parties and determining fault, while health and property insurance claims are typically more straightforward and involve direct reimbursement.

- Health insurance claims may require pre-authorization for certain procedures, unlike auto and property insurance claims.

- Property insurance claims may involve additional steps such as temporary housing arrangements or business interruption coverage, which are not typically part of auto or health insurance claims.

Documentation Required for Insurance Claims

When filing an insurance claim, having the right documentation is crucial to ensure a smooth process and timely payout. Proper documentation helps insurance companies verify the validity of the claim and process it efficiently. Here are the essential documents needed for insurance claims, along with examples for different types of claims:

Essential Documents for Insurance Claims

- Policy details: Provide a copy of your insurance policy to prove coverage.

- Claim form: Fill out the required claim form provided by the insurance company.

- Evidence of loss: Include documentation such as photos, videos, or receipts to support your claim.

- Police report: For claims related to theft, vandalism, or accidents, a police report may be required.

- Medical records: For health insurance claims, provide medical reports, bills, and treatment records.

Examples of Common Documentation for Insurance Claims

- Auto insurance: In case of a car accident, provide a copy of the police report, repair estimates, and photos of the damage.

- Home insurance: For property damage claims, include receipts for damaged items, repair estimates, and inventory lists.

- Health insurance: Submit medical bills, prescriptions, and doctor’s notes for reimbursement of medical expenses.

- Life insurance: In the event of a death claim, provide a death certificate, policy documents, and beneficiary information.

Role of Insurance Adjusters: Insurance Claims Process

Insurance adjusters play a crucial role in the insurance claims process. They are responsible for evaluating claims, determining the settlement amount, and ensuring that policyholders receive fair compensation for their losses.

Responsibilities of Insurance Adjusters

- Investigate the claim: Insurance adjusters conduct a thorough investigation to determine the validity of the claim and the extent of the loss.

- Evaluate the damages: They assess the damage to property or injuries sustained to determine the appropriate compensation.

- Negotiate settlements: Adjusters work with policyholders and other parties involved to negotiate a fair settlement amount.

- Review policy coverage: They review the insurance policy to ensure that the claim falls within the coverage provided.

Determining Settlement Amount

- Assessment of damages: Insurance adjusters use their expertise to assess the extent of the damages and calculate the cost of repairs or replacements.

- Comparative analysis: They may compare the claim with similar cases or industry standards to determine a fair settlement amount.

- Consideration of policy limits: Adjusters take into account the policy limits and exclusions to determine the maximum amount that can be paid out.

- Negotiation skills: Adjusters use their negotiation skills to reach a settlement that is acceptable to both parties.