Car financing options set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

If you’re ready to dive into the world of car financing, buckle up and get ready to explore a range of options that can make your dream car a reality. From loans to leases and dealership financing, the road to vehicle ownership is paved with exciting choices and important decisions.

Types of Car Financing Options

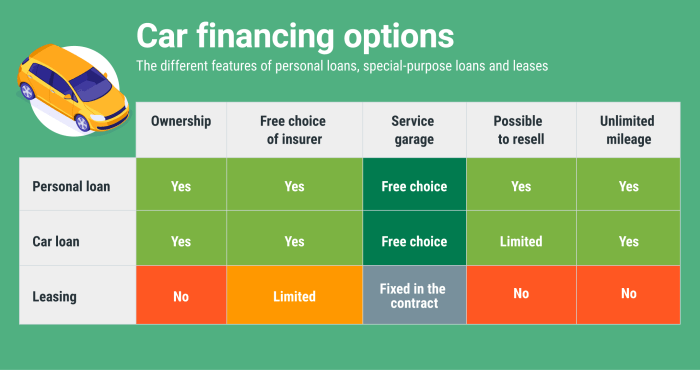

When it comes to purchasing a car, there are different types of car financing options available to help you afford the vehicle of your dreams. These options include loans, leases, and dealership financing.

Car Loans

Car loans are a popular financing option where you borrow money from a lender to purchase a car. You then make monthly payments, including interest, until the loan is paid off.

- Advantages:

- Ownership of the car once the loan is paid off

- Ability to customize the vehicle

- Disadvantages:

- Higher monthly payments compared to leases

- Potential depreciation of the car’s value over time

To be eligible for a car loan, you typically need a good credit score and stable income to demonstrate your ability to repay the loan.

Car Leases

Car leases allow you to “rent” a vehicle for a set period, usually 2-3 years, with the option to purchase the car at the end of the lease term. You make monthly payments based on the car’s depreciation during the lease period.

- Advantages:

- Lower monthly payments compared to loans

- Ability to drive a new car every few years

- Disadvantages:

- No ownership of the vehicle at the end of the lease

- Potential additional fees for exceeding mileage limits or wear and tear

Eligibility criteria for car leases often include a good credit score and stable income to demonstrate your ability to make monthly lease payments.

Dealership Financing

Dealership financing is when you secure a loan directly through the car dealership where you are purchasing the vehicle. The dealership acts as a middleman between you and the lender.

- Advantages:

- Convenient one-stop shopping experience

- Potential promotional offers or incentives from the dealership

- Disadvantages:

- May have higher interest rates compared to other financing options

- Less negotiating power on the loan terms

Eligibility criteria for dealership financing may vary but often require proof of income and a good credit score to qualify for the loan.

Interest Rates and Terms: Car Financing Options

When it comes to car financing options, interest rates play a crucial role in determining the overall cost of the loan. Understanding the difference between fixed and variable interest rates, as well as common terms associated with car financing, can help you make informed decisions.

Fixed vs. Variable Interest Rates

Fixed interest rates remain constant throughout the duration of the loan, providing predictability in monthly payments. On the other hand, variable interest rates can fluctuate based on market conditions, potentially leading to changes in monthly payments.

Common Terms in Car Financing

- APR (Annual Percentage Rate): This rate includes the interest rate and any additional fees, giving you a comprehensive view of the total cost of borrowing.

- Loan Term: The length of time you have to repay the loan. Shorter loan terms typically come with lower interest rates but higher monthly payments.

- Down Payment: The initial amount you pay upfront, which can affect the loan amount and interest rate.

- Loan-to-Value Ratio (LTV): The ratio of the loan amount to the car’s value. A lower LTV ratio may result in better interest rates.

- Grace Period: The time before interest starts accruing on the loan, usually after missing a payment deadline.

Credit Score and Car Financing

When it comes to securing car financing, your credit score plays a crucial role in determining the options available to you. Lenders use your credit score to assess your creditworthiness and decide whether to approve your loan application. A higher credit score typically results in better financing deals, such as lower interest rates and more favorable terms.

Tips to Improve Credit Scores

- Pay your bills on time: Late payments can significantly impact your credit score negatively.

- Reduce credit card balances: High credit utilization can lower your credit score.

- Monitor your credit report: Check for errors and dispute any inaccuracies to ensure an accurate credit score.

- Avoid opening new credit accounts frequently: Multiple credit inquiries can hurt your credit score.

Impact of Credit Scores on Different Car Financing Options

Your credit score can have varying effects on different types of car financing options. For example:

| Car Financing Option | Impact of Credit Score |

|---|---|

| Traditional Auto Loans | A higher credit score can secure lower interest rates and more favorable terms. |

| Leasing | Leasing companies often require a good credit score to qualify for a lease. |

| Buy Here Pay Here Dealerships | These dealerships may offer financing options regardless of credit score, but with higher interest rates for lower scores. |

Down Payments and Monthly Payments

When it comes to car financing, down payments play a crucial role in determining the overall cost of the loan and the monthly payments you’ll need to make. Understanding the significance of down payments can help you make informed decisions and secure the best deal possible.

Significance of Down Payments

Down payments are the initial upfront cash you pay towards the purchase of a car. They serve as a way to reduce the total amount you need to borrow, which can lead to lower monthly payments and less interest paid over the life of the loan. Lenders often view larger down payments favorably, as they indicate financial stability and reduce the risk of default.

Determining an Appropriate Down Payment Amount

When deciding on the right down payment amount, consider your budget, financial goals, and the value of the car you’re purchasing. A general rule of thumb is to aim for a down payment of at least 20% of the car’s purchase price. However, it’s essential to balance your down payment with other financial priorities, such as emergency savings or investments.

Impact on Monthly Payments and Loan Terms

A higher down payment typically results in lower monthly payments since you’re borrowing less money. Additionally, a larger down payment can lead to better loan terms, such as lower interest rates or a shorter loan duration. On the other hand, a smaller down payment may result in higher monthly payments and potentially higher overall interest costs.