Car insurance policies are crucial for protecting your vehicle and yourself on the road. From understanding coverage options to factors affecting premiums, this comprehensive guide will help you navigate the world of car insurance with ease.

Overview of Car Insurance Policies

Car insurance policies are crucial for protecting both drivers and vehicles on the road. These policies provide financial coverage in case of accidents, theft, or damage to the insured vehicle. They are essential for ensuring peace of mind and complying with legal requirements.

Types of Coverage in Car Insurance Policies

- Liability Coverage: Covers costs if you’re at fault in an accident that causes injury or property damage to others.

- Collision Coverage: Pays for repairs to your vehicle after a collision with another vehicle or object.

- Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers regardless of fault.

Factors Influencing Car Insurance Costs

- Driving Record: Safe drivers typically pay lower premiums.

- Vehicle Type: Luxury cars or high-performance vehicles may have higher insurance costs.

- Location: Urban areas with higher crime rates may result in higher premiums.

- Age and Gender: Younger drivers and males tend to pay more for insurance.

Benefits of Comprehensive Car Insurance

- Full Coverage: Protects against a wide range of risks, giving peace of mind.

- Financial Security: Helps cover repair or replacement costs in case of accidents or theft.

- Legal Compliance: Mandatory in most states to have at least liability insurance.

Types of Car Insurance Coverage

Car insurance policies offer various types of coverage options to protect drivers in different situations. Understanding the different types of coverage available can help you choose the best policy for your needs.

Liability Coverage

Liability coverage protects you if you are at fault in an accident and cause injury or damage to another person or their property. This coverage helps pay for the other party’s medical bills, vehicle repairs, or property damage. It does not cover your own expenses.

Collision Coverage

Collision coverage pays for repairs to your vehicle if you are involved in an accident with another vehicle or object, regardless of who is at fault. This coverage is beneficial in scenarios where you collide with another car or hit a stationary object like a tree or pole.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, natural disasters, or hitting an animal. This coverage is useful in scenarios where your car is stolen, damaged by a storm, or vandalized.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage provides protection if you are involved in an accident with a driver who does not have insurance or has insufficient coverage to pay for damages. This coverage is beneficial in scenarios where the other driver is at fault but cannot cover your expenses.

Legal Requirements for Car Insurance Coverage, Car insurance policies

The legal requirements for car insurance coverage vary by state, but most states require drivers to have a minimum amount of liability coverage. Some states may also require uninsured/underinsured motorist coverage. It’s essential to understand the specific requirements in your region to ensure you are compliant with the law.

Factors Affecting Car Insurance Premiums

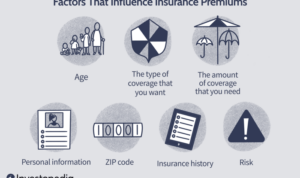

When it comes to calculating car insurance premiums, insurance companies take several key factors into consideration. These factors can significantly impact the cost of your insurance coverage. Let’s dive into the main factors that affect car insurance premiums.

Age

Age plays a crucial role in determining car insurance premiums. Younger drivers, especially teenagers, are considered high-risk drivers due to their lack of experience on the road. As a result, insurance rates are typically higher for this age group. On the other hand, older, more experienced drivers usually enjoy lower premiums.

Driving Record

Your driving record is another crucial factor that influences car insurance premiums. If you have a history of accidents, speeding tickets, or other traffic violations, insurance companies may view you as a higher risk driver, leading to higher premiums. On the contrary, a clean driving record can help you secure lower insurance rates.

Location

Where you live also plays a role in determining your car insurance premiums. Urban areas with high rates of traffic accidents and theft may result in higher insurance costs compared to rural areas. Additionally, states with no-fault insurance laws or high rates of uninsured drivers may have higher premiums.

Type of Vehicle

The type of vehicle you drive can impact your insurance premiums. Sports cars and luxury vehicles typically cost more to insure due to higher repair costs and increased risk of theft. On the other hand, safe, reliable, and low-profile vehicles usually come with lower insurance rates.

Coverage Limits

The coverage limits you choose for your car insurance policy can also affect your premiums. Opting for higher coverage limits and additional coverage options, such as comprehensive and collision coverage, can lead to higher premiums. On the other hand, selecting lower coverage limits may result in more affordable insurance rates.

Ways to Lower Car Insurance Premiums

There are several ways to potentially lower your car insurance premiums. Consider bundling your policies with the same insurance company, taking defensive driving courses to improve your driving skills, and maintaining a good credit score. These actions can help you save money on your insurance costs.

Maintaining a Good Driving Record

One of the most effective ways to keep your insurance costs down is by maintaining a good driving record. Avoiding traffic violations, accidents, and other risky behaviors on the road can help you secure lower insurance premiums over time. Remember, safe driving not only keeps you and others safe but also saves you money on insurance.

Tips for Choosing the Right Car Insurance Policy: Car Insurance Policies

When it comes to selecting the right car insurance policy, there are several important factors to consider. From coverage options to premium costs, making the right choice can save you money and provide peace of mind on the road.

Considerations When Comparing Different Insurance Options

- Review Coverage Options: Look at the types of coverage offered by each policy, such as liability, collision, and comprehensive coverage.

- Compare Premium Costs: Get quotes from multiple insurance companies and compare the costs of each policy, taking into account any discounts or special offers.

- Check Policy Details: Pay close attention to the details of each policy, including coverage limits, deductibles, and any exclusions that may apply.

- Consider Customer Reviews: Look for feedback from other customers to gauge the quality of service and claims process of each insurance company.

Tailoring a Car Insurance Policy to Individual Needs and Budget

- Assess Your Driving Habits: Consider how often you drive, where you drive, and your driving record to determine the appropriate level of coverage.

- Choose Deductibles Wisely: Opt for deductibles that you can afford in the event of a claim but also consider how they affect your premium costs.

- Add Optional Coverage: Evaluate optional add-ons like roadside assistance, rental car coverage, or gap insurance to tailor your policy to your specific needs.

- Bundle Policies: If you have multiple insurance needs, consider bundling your car insurance with other policies to save money on premiums.