Crypto staking rewards have taken the financial world by storm, offering a unique opportunity to earn passive income in the exciting realm of cryptocurrency. Get ready to dive into the ins and outs of this lucrative practice, from understanding the basics to maximizing your rewards.

Overview of Crypto Staking Rewards

Cryptocurrency staking rewards are incentives given to participants who hold and lock a certain amount of coins in a staking wallet to support the blockchain network. By staking their coins, participants help validate transactions and maintain the network’s security, in return for earning rewards in the form of additional coins.

Staking rewards provide an opportunity for crypto holders to earn passive income on their investments, without the need for expensive mining equipment. The process is also more energy-efficient compared to traditional proof-of-work mining.

Popular Cryptocurrencies Offering Staking Rewards

- Ethereum (ETH): One of the largest cryptocurrencies offering staking rewards through its Ethereum 2.0 upgrade, allowing users to stake ETH to secure the network and earn rewards.

- Cardano (ADA): Cardano utilizes a proof-of-stake consensus mechanism, enabling ADA holders to stake their coins and receive staking rewards.

- Tezos (XTZ): Tezos operates on a self-amending blockchain and allows users to delegate their coins to a validator and earn staking rewards.

How to Earn Crypto Staking Rewards

To earn crypto staking rewards, you need to actively participate in the network by locking up your cryptocurrency holdings to support the blockchain’s operations. In return, you receive rewards in the form of additional coins.

Staking Process

Staking involves holding a certain amount of a specific cryptocurrency in a digital wallet for a predetermined period. This process helps secure the network and validate transactions through a consensus mechanism known as Proof of Stake (PoS).

- Choose a Staking Coin: Select a cryptocurrency that supports staking rewards and transfer the coins to a compatible wallet.

- Stake Your Coins: Lock up your coins in the wallet to participate in the staking process and start earning rewards.

- Participate in Network Consensus: By staking your coins, you contribute to the blockchain’s security and validate transactions, helping maintain the network’s integrity.

Staking Methods

There are different staking methods available in the crypto space to earn rewards:

- Self-Staking: Directly stake your coins in your wallet and manage the staking process yourself.

- Staking Pools: Join a staking pool where multiple users combine their resources to increase their chances of earning rewards.

- Staking Platforms: Utilize third-party staking platforms or exchanges that offer staking services for various cryptocurrencies.

Maximizing Staking Rewards

To maximize your staking rewards, consider the following tips:

- Choose a Reliable Staking Provider: Select a reputable staking platform or pool with a proven track record of distributing rewards.

- Diversify Your Staking Portfolio: Stake a variety of cryptocurrencies to spread your risk and potentially increase your overall rewards.

- Stay Informed: Keep up to date with the latest developments in the staking space to make informed decisions and optimize your staking strategy.

Factors Influencing Staking Rewards

Cryptocurrency staking rewards are influenced by several key factors that determine the amount of rewards a participant can earn. Understanding these factors is crucial for maximizing the potential returns from staking activities.

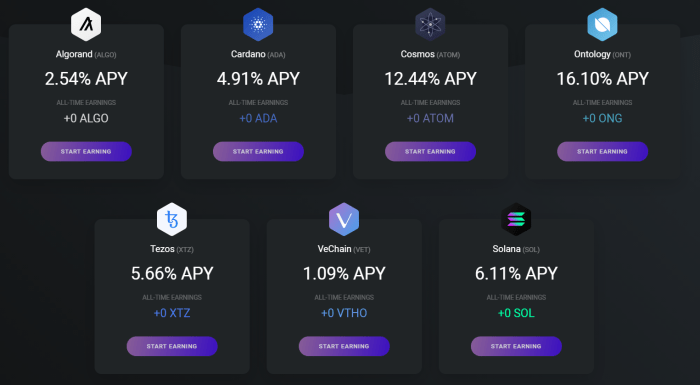

One of the primary factors that influence staking rewards is the annual percentage yield (APY) offered by the cryptocurrency network. Different cryptocurrencies offer varying APY rates for staking, which can impact the overall rewards earned by participants. Generally, higher APY rates result in greater staking rewards.

Another important factor is the total supply of the cryptocurrency being staked. Cryptocurrencies with a limited supply typically offer higher staking rewards compared to those with a larger supply. This is because the scarcity of the cryptocurrency drives up demand for staking, leading to increased rewards for participants.

Network participation also plays a significant role in determining staking rewards. The more participants actively staking on the network, the lower the rewards for each individual participant. Conversely, a decrease in network participation can result in higher rewards for stakers.

Additionally, the price of the staked cryptocurrency in the market can impact staking rewards. Fluctuations in the token price can affect the overall value of staking rewards earned by participants. Therefore, it is essential for stakers to consider the market conditions and token price movements when engaging in staking activities.

Comparing Staking Rewards Across Cryptocurrencies

When comparing staking rewards across different cryptocurrencies, it is essential to consider factors such as APY rates, total supply, network participation, and token price. Each cryptocurrency has its unique staking model and reward structure, which can impact the overall returns for stakers. Conducting thorough research and understanding these factors can help participants choose the most profitable staking opportunities.

Risks Associated with Crypto Staking Rewards

When it comes to staking cryptocurrencies for rewards, there are certain risks that investors should be aware of. One of the main risks is market volatility, which can greatly impact the staking returns that investors receive.

Market Volatility Impact, Crypto staking rewards

Market volatility refers to the rapid and unpredictable changes in the price of cryptocurrencies. When the market is highly volatile, the value of the staked assets can fluctuate significantly. This can result in lower returns for stakers, as the value of their rewards may decrease before they have a chance to cash them out.

To mitigate the risks associated with market volatility while staking for rewards, investors can consider diversifying their staking portfolio. By spreading their investments across different cryptocurrencies or projects, investors can reduce their exposure to the price fluctuations of any single asset. Additionally, investors can set stop-loss orders to automatically sell their staked assets if the price drops below a certain threshold, limiting their potential losses.

Overall, understanding the risks associated with crypto staking rewards, particularly market volatility, is crucial for investors looking to maximize their returns while minimizing potential losses.