Customer Acquisition Cost sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

When it comes to understanding the cost of acquiring customers, there’s a lot more than meets the eye. From calculating CAC to optimizing strategies, this topic dives deep into the world of marketing metrics.

What is Customer Acquisition Cost (CAC)?

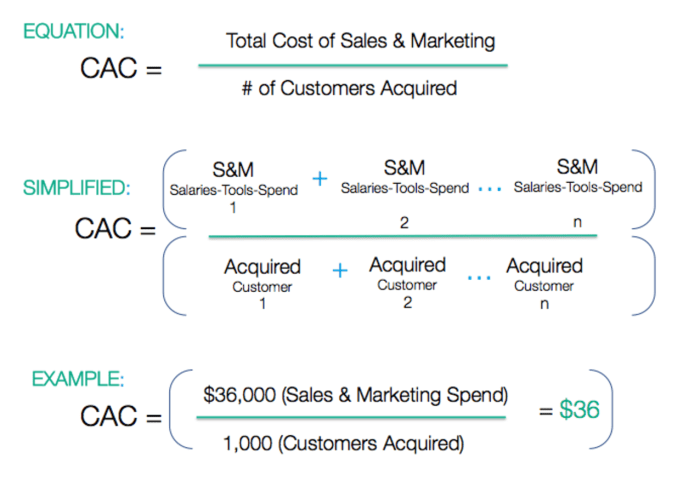

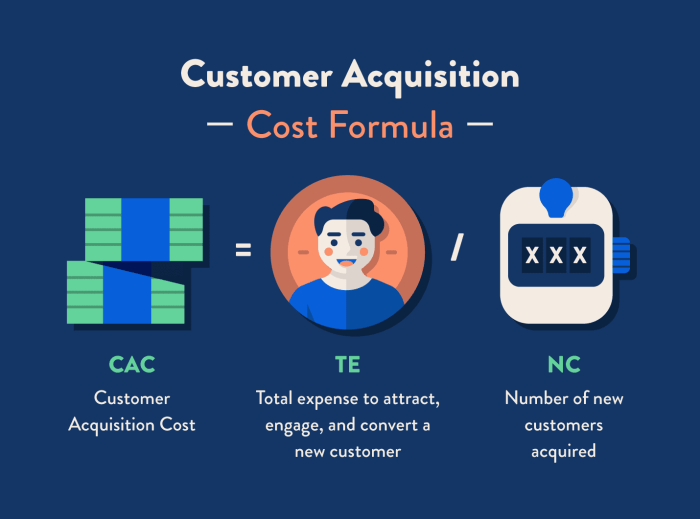

Customer Acquisition Cost (CAC) is the amount of money a business needs to spend in order to acquire a new customer. It is an important metric for companies to understand how much they are investing to bring in new business.

CAC is calculated by dividing the total costs associated with acquiring customers (such as marketing expenses, sales team salaries, and advertising costs) by the number of customers acquired during a specific time period.

Examples of CAC in Different Industries

- In the e-commerce industry, CAC can include costs related to online advertising, social media marketing, and website development. For example, if an e-commerce company spends $10,000 on marketing efforts and acquires 100 new customers, the CAC would be $100 per customer.

- In the software industry, CAC may involve expenses for software development, sales team salaries, and online advertising. If a software company spends $20,000 on marketing and sales activities and gains 50 new customers, the CAC would be $400 per customer.

- In the retail industry, CAC can encompass costs for physical store locations, advertising campaigns, and promotions. For instance, if a retail store spends $5,000 on marketing and attracts 200 new customers, the CAC would be $25 per customer.

Factors influencing Customer Acquisition Cost

In the world of business, understanding the factors that influence Customer Acquisition Cost (CAC) is crucial for maximizing profitability and efficiency in marketing strategies. Let’s dive into some key elements that impact CAC.

Marketing Channels, Customer Acquisition Cost

Marketing channels play a significant role in determining the overall CAC for a business. Different channels have varying costs associated with acquiring customers. For example, digital marketing channels like social media ads or Google AdWords may have different cost structures compared to traditional channels like print advertising or direct mail campaigns. It is essential for businesses to analyze the performance of each channel and allocate resources effectively to optimize CAC.

Customer Lifetime Value

Customer Lifetime Value (CLV) is another crucial factor that influences CAC. CLV represents the total revenue a customer is expected to generate over the entire relationship with a business. By increasing CLV, a business can justify higher CAC, as long as the return on investment is positive in the long run. Understanding the lifetime value of customers helps businesses make informed decisions about acquisition costs and customer retention strategies.

Conversion Rates

Conversion rates also impact CAC significantly. A higher conversion rate means that more leads turn into actual customers, reducing the overall cost of acquiring each customer. Businesses should focus on optimizing conversion rates through targeted marketing campaigns, personalized messaging, and seamless customer experiences to lower CAC and improve overall profitability.

Competitive Landscape

The competitive landscape can affect CAC by influencing customer acquisition strategies and marketing costs. In a competitive market, businesses may need to invest more in marketing efforts to stand out from competitors and attract customers. Understanding the competitive landscape helps businesses adjust their CAC strategies accordingly to stay competitive while maintaining profitability.

Customer Segmentation

Customer segmentation plays a critical role in determining CAC. Different customer segments may have varying acquisition costs based on their preferences, behaviors, and demographics. By targeting specific customer segments with personalized marketing strategies, businesses can optimize CAC by focusing resources on the most valuable customers and increasing overall ROI.

Strategies to optimize Customer Acquisition Cost

In order to reduce Customer Acquisition Cost (CAC) effectively, it is essential to implement strategic approaches that target the right audience and improve conversion rates. By focusing on these key areas, businesses can optimize their CAC and maximize their return on investment.

Targeting the Right Audience

- Utilize data analytics to identify the most profitable customer segments.

- Refine your marketing messages to resonate with the specific needs and preferences of your target audience.

- Invest in targeted advertising campaigns on platforms where your audience is most active.

- Implement personalized marketing strategies to enhance customer engagement and loyalty.

Improving Conversion Rates

- Optimize your website and landing pages for a seamless user experience and clear call-to-actions.

- A/B test different elements of your marketing campaigns to identify what resonates best with your audience.

- Implement retargeting strategies to re-engage with potential customers who have shown interest but have not converted yet.

- Offer incentives or promotions to encourage customers to take action and complete their purchase.

Calculating and analyzing Customer Acquisition Cost

To effectively manage your marketing budget and optimize your customer acquisition strategies, it is crucial to calculate and analyze your Customer Acquisition Cost (CAC) accurately. Here’s a step-by-step guide on calculating CAC, the significance of benchmarking CAC, and methods to analyze its effectiveness.

Step-by-Step Guide on Calculating CAC

- Calculate Total Marketing and Sales Expenses: Add up all costs related to marketing and sales efforts, including salaries, advertising, software, and other expenses.

- Calculate New Customers Acquired: Determine the number of new customers gained during a specific period.

- Divide Total Marketing and Sales Expenses by New Customers Acquired: Divide the total expenses by the number of new customers to get the Customer Acquisition Cost.

Significance of Benchmarking CAC

Benchmarking your CAC against industry standards or your own historical data can provide valuable insights into the efficiency of your customer acquisition strategies. By comparing your CAC to benchmarks, you can identify areas for improvement and make data-driven decisions to optimize your marketing efforts.

Methods to Analyze CAC Effectiveness

- Track CAC Over Time: Monitor changes in your CAC to understand how it fluctuates with different marketing campaigns or strategies.

- Calculate Customer Lifetime Value (CLV): Compare CAC to CLV to ensure that the cost of acquiring a customer is lower than the value they bring to your business over their lifetime.

- Segment CAC by Marketing Channels: Analyze CAC based on different marketing channels to identify the most cost-effective channels and allocate resources accordingly.