Debt consolidation, a smart move for financial stability, is a game-changer in handling multiple debts efficiently. From understanding the basics to exploring different types and processes, this guide has got you covered.

Let’s dive into the world of debt consolidation and learn how to take control of your finances like a boss.

What is Debt Consolidation?

Debt consolidation is a financial strategy that involves combining multiple debts into a single loan or payment. The primary purpose of debt consolidation is to streamline debt management and potentially lower overall interest rates, making it easier for individuals to pay off their debts.

How Debt Consolidation Works

Debt consolidation works by taking out a new loan to pay off existing debts. This new loan typically comes with a lower interest rate than the individual debts being consolidated, which can save money in the long run. By consolidating debts, individuals can simplify their monthly payments and potentially reduce the total amount of interest paid over time.

Benefits of Debt Consolidation

- Lower Interest Rates: Debt consolidation can often lead to lower overall interest rates, saving money in the long term.

- Single Monthly Payment: Instead of managing multiple payments, debt consolidation allows for a single monthly payment, making it easier to keep track of finances.

- Improved Credit Score: Successfully managing a debt consolidation loan can have a positive impact on credit scores by showing responsible debt management.

- Reduced Stress: By consolidating debts, individuals can reduce the stress and anxiety associated with managing multiple debts and due dates.

Types of Debt Consolidation

Debt consolidation can come in various forms, each with its own set of pros and cons. Here are some common types of debt consolidation to consider:

1. Balance Transfer

A balance transfer involves moving all of your high-interest credit card debt onto a new credit card with a lower interest rate. This can help you save money on interest payments and simplify your debt repayment process.

Pros:

- Lower interest rates

- Consolidates multiple debts into one

Cons:

- May come with balance transfer fees

- Introductory interest rates may expire

Balance transfers are most suitable for those with good credit scores who can pay off their debt within the introductory period.

2. Personal Loan

A personal loan is a lump sum of money borrowed from a financial institution to pay off your existing debts. This loan typically has a fixed interest rate and repayment term.

Pros:

- Fixed monthly payments

- Potentially lower interest rates

Cons:

- May require collateral

- Could result in a longer repayment term

Personal loans are ideal for those looking for a structured repayment plan and have a steady income to make monthly payments.

3. Debt Management Plan

A debt management plan involves working with a credit counseling agency to negotiate lower interest rates and monthly payments with your creditors. You make one monthly payment to the agency, which then distributes the funds to your creditors.

Pros:

- Lower interest rates

- Professional guidance

Cons:

- May damage your credit score

- Requires discipline to stick to the plan

Debt management plans are suitable for individuals struggling with high-interest debt and looking for professional assistance to manage their payments.

Process of Debt Consolidation

When it comes to the process of debt consolidation, there are several key steps involved that individuals should be aware of before making a decision. Debt consolidation is a strategy that combines multiple debts into a single, more manageable loan with a lower interest rate. This can help simplify financial obligations and make it easier to pay off debt over time.

Determining if Debt Consolidation is Right for You

- Assess Your Financial Situation: Before considering debt consolidation, take a close look at your current financial status. Evaluate your total debt, income, expenses, and interest rates on existing loans.

- Compare Interest Rates: Calculate the average interest rate you are currently paying on your debts versus the potential interest rate offered through a debt consolidation loan. Determine if the savings would be significant enough to make a difference.

- Consider Repayment Terms: Review the repayment terms of a potential debt consolidation loan and ensure it aligns with your budget and financial goals. Make sure you can comfortably afford the monthly payments.

Finding Reputable Debt Consolidation Companies

- Research and Compare: Take the time to research different debt consolidation companies and compare their services, fees, and customer reviews. Look for companies with a solid reputation and track record of helping individuals successfully consolidate their debts.

- Check Credentials: Verify that the debt consolidation company is legitimate and accredited by checking for certifications and licenses. Avoid companies that make unrealistic promises or charge exorbitant fees.

- Consult with a Financial Advisor: Seek guidance from a financial advisor or credit counselor to get personalized advice on the best debt consolidation options for your specific situation. They can help you navigate the process and avoid potential pitfalls.

Factors to Consider

Before opting for debt consolidation, there are several key factors to consider. It’s important to assess your financial situation, understand the impact of debt consolidation on your credit score, and be aware of potential scams in the industry.

Impact of Credit Score, Debt consolidation

Your credit score plays a crucial role in determining the debt consolidation options available to you. Lenders will typically offer better terms and interest rates to borrowers with higher credit scores. If your credit score is low, you may have limited options or be required to pay higher interest rates. It’s essential to check your credit score before pursuing debt consolidation and work on improving it if necessary.

Avoiding Scams and Pitfalls

When considering debt consolidation, be wary of scams and predatory lending practices. Some companies may promise quick fixes or guaranteed approval, but these are often red flags for scams. To avoid falling victim to fraudulent schemes, research potential lenders, read reviews, and verify their credentials. Additionally, be cautious of high fees, hidden charges, and unrealistic promises. It’s crucial to carefully review the terms and conditions of any debt consolidation offer and seek advice from a financial advisor if needed.

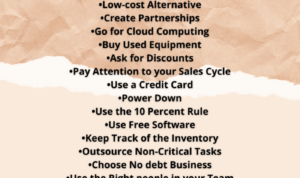

Alternatives to Debt Consolidation

When it comes to managing and paying off debt, there are alternatives to debt consolidation that you can consider. These alternatives offer different approaches to addressing your financial situation, so it’s important to explore all options before making a decision.

Debt Settlement

Debt settlement involves negotiating with creditors to settle your debts for less than what you owe. This can be a viable option if you have a significant amount of debt that you are struggling to pay off. However, it can negatively impact your credit score and may result in having to pay taxes on the forgiven debt.

Bankruptcy

Bankruptcy is a legal process that can help you eliminate or restructure your debts when you are unable to repay them. While bankruptcy can provide a fresh start, it has serious consequences on your credit score and financial future. It should be considered as a last resort when all other options have been exhausted.

Other Debt Relief Options

There are other debt relief options available, such as credit counseling, debt management plans, and debt settlement programs. These alternatives may offer different ways to reduce your debt burden and improve your financial situation. It’s important to research and understand the pros and cons of each option before making a decision.