Flood insurance policies set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset. From understanding the basics to navigating complex coverage options, this guide dives deep into the world of flood insurance policies.

Overview of Flood Insurance Policies

Flood insurance policies are specialized insurance plans that provide coverage for property damage caused by floods. They are important because standard homeowners’ insurance typically does not cover flood-related damages, leaving homeowners vulnerable to significant financial loss in the event of a flood.

Importance of Flood Insurance

- Protects your home and belongings from flood damage

- Provides financial assistance for repairs and replacements

- Offers peace of mind in the face of natural disasters

Benefits of Flood Insurance, Flood insurance policies

- Helps cover costs of rebuilding or repairing your home

- Assists in replacing damaged belongings

- May provide living expenses if you are displaced due to a flood

Difference from Homeowners’ Insurance

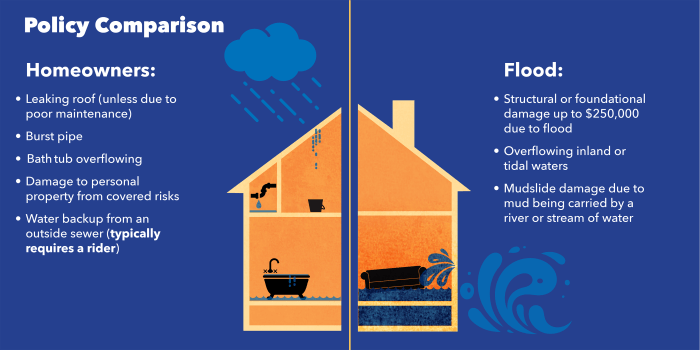

Flood insurance policies specifically cover damages caused by floods, while standard homeowners’ insurance typically excludes flood damage from its coverage. Homeowners’ insurance usually covers damages from fire, theft, and certain natural disasters, but not floods.

Statistics on Homeowners with Flood Insurance

According to FEMA, only around 15% of homeowners nationwide have flood insurance. This leaves a large portion of homeowners at risk of financial devastation in the event of a flood.

Types of Flood Insurance Coverage: Flood Insurance Policies

When it comes to flood insurance coverage, there are different options available to homeowners. Let’s take a look at the types of flood insurance coverage, including government-backed and private policies.

Government-backed Flood Insurance Policies vs Private Flood Insurance Policies

- Government-backed policies, such as those offered through the National Flood Insurance Program (NFIP), are backed by the federal government and have set coverage limits.

- Private flood insurance policies, on the other hand, are offered by private insurance companies and may offer higher coverage limits and additional benefits.

- Government-backed policies are often more affordable but may have more restrictions on coverage, while private policies may offer more flexibility but come at a higher cost.

Standard Coverage Under Flood Insurance Policies

- Standard flood insurance policies typically cover damage to the structure of the home and its foundation, as well as electrical and plumbing systems.

- They also usually cover appliances, such as refrigerators and stoves, damaged by flooding.

- Personal belongings, such as furniture and clothing, are also typically covered under a standard flood insurance policy.

Exclusions and Limitations in Flood Insurance Coverage

- Some common exclusions in flood insurance coverage include damage caused by mold, mildew, or moisture that could have been prevented by the homeowner.

- Additional living expenses, such as temporary housing, may not be covered under a standard flood insurance policy.

- Coverage for detached structures, such as sheds or garages, may have limitations depending on the policy.

Determining Flood Insurance Needs

Determining the right amount of flood insurance coverage is crucial to protecting your property and belongings in case of a flood. Here’s a guide on how to assess your flood insurance needs:

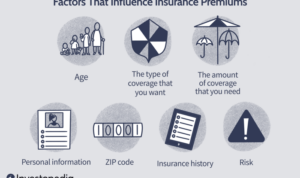

Factors Influencing Cost of Flood Insurance

- Location: Properties located in high-risk flood zones will generally have higher premiums.

- Property Value: The value of your property and belongings will impact the cost of coverage.

- Elevation: The height of your property above the base flood elevation can affect insurance rates.

- Construction: The materials and design of your property can influence the cost of insurance.

Impact of Flood Zones on Insurance Decision

- Flood Zones: Properties located in Special Flood Hazard Areas (SFHAs) are required to have flood insurance if they have a mortgage from a federally regulated or insured lender.

- Risk Levels: Understanding the flood risk level of your property can help you determine the necessity of purchasing flood insurance.

Tips for Determining Adequate Coverage Levels

- Assess Property Value: Calculate the value of your property and belongings to determine the appropriate coverage amount.

- Consider Additional Coverage: Evaluate if you need additional coverage for personal belongings or living expenses in case of displacement due to a flood.

- Consult with an Agent: Seek guidance from an insurance agent to understand your options and determine the right coverage levels for your property.

- Review Policy Annually: Regularly review your flood insurance policy to ensure it aligns with any changes in your property or belongings.

Making Claims and Understanding Coverage

When it comes to filing a flood insurance claim, it’s crucial to understand the process to ensure a smooth experience. Let’s dive into the common challenges, coverage limits, and scenarios where claims may be denied.

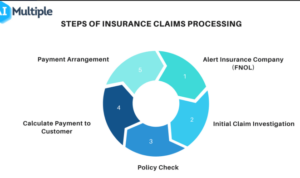

Filing a Flood Insurance Claim

- Notify your insurance company immediately after the flood occurs.

- Document the damage with photos and videos.

- Fill out the necessary claim forms provided by your insurer.

- An adjuster will assess the damage and determine the coverage amount.

Common Challenges in Making Flood Insurance Claims

- Underestimating the extent of damage, leading to insufficient claims.

- Failure to provide proper documentation of the damage.

- Disputes over the cause of the damage, such as whether it was due to flooding or another issue.

Coverage Limits in Flood Insurance Policies

- Coverage limits are determined based on the policy you purchased.

- Most policies have limits for building property and personal property coverage.

- Excess flood insurance can be purchased for additional coverage beyond the standard limits.

Scenarios for Denied Flood Insurance Claims

- Damage caused by a flood that is not covered by the policy.

- Failure to maintain the property to prevent flooding, leading to denial of the claim.

- Submitting a claim for damage that existed before the flood occurred.