When it comes to insurance premium calculation, various factors come into play, impacting the final cost you pay. From age and gender to cutting-edge technology advancements, understanding how these elements influence your premium is key. Let’s dive into the world of insurance premium calculation with an intriguing twist.

Exploring the methods, technologies, and significance behind accurate premium calculation can shed light on the intricate process that determines your insurance costs.

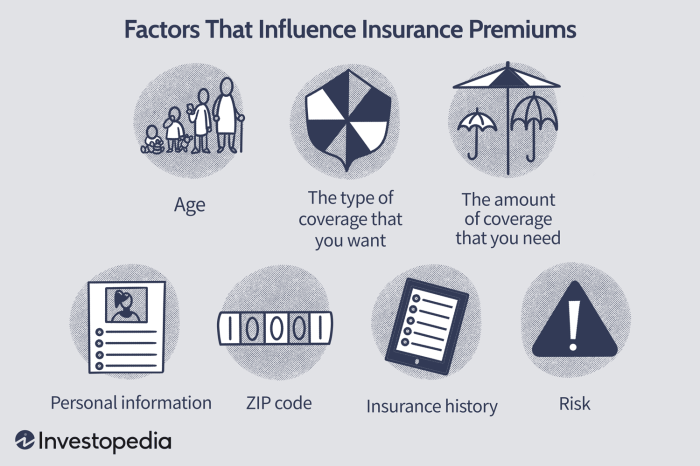

Factors influencing insurance premium calculation

When it comes to calculating insurance premiums, several factors come into play that can either increase or decrease the amount you pay. These factors include age, gender, location, driving record, and the type of coverage you choose.

Age

Age is a significant factor in determining insurance premiums. Younger drivers typically pay higher premiums as they are considered riskier due to less driving experience. On the other hand, older drivers may also face higher premiums as they are more prone to certain medical conditions and accidents.

Gender

Believe it or not, gender can impact insurance premiums. Statistically, male drivers tend to be involved in more accidents than female drivers, leading to higher premiums for males. However, this gap is narrowing as more insurers move towards gender-neutral pricing.

Location

Where you live plays a crucial role in determining your insurance premium. Urban areas with higher population density and more traffic tend to have higher premiums compared to rural areas. This is because the likelihood of accidents and theft is higher in urban settings.

Driving Record

Your driving record is a direct reflection of your driving habits and skills. A clean driving record with no accidents or traffic violations will generally result in lower premiums. On the other hand, a history of accidents or tickets can lead to increased premiums.

Type of Coverage

The type of coverage you choose also affects your insurance premium. Comprehensive coverage that offers a wide range of protections will naturally come with a higher price tag. On the other hand, basic liability coverage may be more affordable but provides limited coverage in case of an accident.

Consideration of these factors during the insurance premium calculation process helps insurers assess the level of risk associated with each policyholder. By analyzing these factors, insurers can determine the likelihood of a claim being filed and adjust premiums accordingly.

Methods used in insurance premium calculation

Insurance companies use various methods to calculate premiums, taking into account different factors to determine the appropriate amount of coverage needed for each policyholder.

Actuarial Method

The actuarial method involves using statistical models and mathematics to analyze risk and predict future claims. Actuaries assess various data points such as age, location, health history, and other relevant information to calculate the premium. This method is commonly used in life insurance and health insurance to determine the likelihood of future claims based on demographic and historical data.

Experience Rating Method

The experience rating method takes into consideration the past claims history of a policyholder. Insurance companies adjust the premium based on the individual’s previous claims experience. For example, if a driver has a history of accidents, their auto insurance premium may be higher compared to someone with a clean driving record. This method is commonly used in auto insurance and workers’ compensation insurance.

Judgment Rating Method

The judgment rating method involves the subjective assessment of risk by underwriters. Underwriters use their expertise and judgment to evaluate the risk associated with insuring a particular individual or business. This method is often used for unique or specialized risks that may not fit well into standard actuarial models. For example, insuring a rare piece of artwork or a high-profile event may require the judgment rating method.

In terms of accuracy and efficiency, the actuarial method is considered the most precise and reliable since it is based on statistical data and predictive models. On the other hand, the judgment rating method may lack consistency and objectivity since it relies on individual underwriters’ assessments. The experience rating method falls in between, providing a balance between past claims data and future projections.

Technology advancements in premium calculation

AI, machine learning, and big data have revolutionized the insurance industry, particularly in the realm of premium calculation. These advanced technologies have enabled insurance companies to enhance accuracy, efficiency, and personalization in determining insurance premiums.

Benefits of using advanced technology

- Increased accuracy: AI algorithms can analyze vast amounts of data to identify patterns and predict risks more precisely, leading to more accurate premium calculations.

- Efficiency: Machine learning algorithms can automate the premium calculation process, reducing the time and resources required for manual calculations.

- Personalization: Big data analytics allow insurers to tailor premiums based on individual risk factors, resulting in fairer pricing for policyholders.

Challenges of using advanced technology

- Data privacy concerns: Handling sensitive customer data for premium calculations raises privacy and security issues that need to be addressed.

- Algorithm bias: AI algorithms may inherit biases from historical data, potentially leading to unfair premium pricing or discrimination.

- Complexity: Implementing and maintaining advanced technology systems for premium calculation requires specialized expertise and resources.

Examples of companies leveraging technology

- Lemonade: Lemonade Insurance, a digital insurance company, uses AI-powered chatbots and machine learning algorithms to streamline the premium calculation process and offer quick policy quotes to customers.

- Allstate: Allstate Insurance utilizes big data analytics to assess risk factors more accurately and adjust premiums accordingly, providing customized insurance solutions to policyholders.

- Progressive: Progressive Insurance employs telematics devices and AI algorithms to track driver behavior and calculate auto insurance premiums based on individual driving habits, promoting safe driving practices.

Importance of accurate premium calculation: Insurance Premium Calculation

Accurate premium calculation is vital for both insurance companies and policyholders as it ensures fairness, sustainability, and financial stability within the insurance industry. When premiums are calculated accurately, it helps insurance companies manage risk effectively and provide adequate coverage to policyholders.

Impact on Insurance Companies, Insurance premium calculation

- Accurate premium calculation allows insurance companies to price their policies correctly based on the risk profile of each policyholder. This helps in maintaining profitability and staying competitive in the market.

- It also helps in preventing underwriting losses and ensures that the company remains financially stable over time.

- With accurate premium calculation, insurance companies can effectively manage their reserves and claims payments, reducing the likelihood of financial strain during times of crisis or high claim volumes.

Impact on Policyholders

- For policyholders, accurate premium calculation means they are paying a fair price for the coverage they receive. This builds trust and confidence in the insurance provider.

- It ensures that policyholders have adequate coverage to protect them in case of unexpected events, giving them peace of mind and financial security.

- Inaccurate premium calculations can lead to policyholders being underinsured or overcharged, resulting in financial hardships or inadequate coverage when they need it the most.

Real-World Scenarios

- During natural disasters like hurricanes or wildfires, insurance companies with accurate premium calculations are better equipped to handle the surge in claims and provide timely assistance to affected policyholders.

- In the healthcare industry, accurate premium calculation ensures that individuals receive the right coverage for their medical needs, preventing financial burdens and ensuring access to quality healthcare services.

- In the auto insurance sector, accurate premium calculation helps in reducing fraudulent claims and maintaining affordable rates for safe drivers, promoting responsible behavior on the road.