Yo, welcome to the ultimate liability insurance guide! We’re about to break down all the deets in a way that’s easy to digest and totally rad. So buckle up and let’s dive in, peeps!

Liability insurance is no joke, and understanding it is key to protecting yourself. Let’s explore what this insurance is all about and why it’s crucial in today’s world.

Introduction to Liability Insurance

Liability insurance is a type of coverage that helps protect individuals and businesses from the risk of being held legally responsible for injuries, damages, or negligence caused to others. It is crucial as it provides financial protection and assistance in legal matters.

Types of Liability Insurance

- General Liability Insurance: Covers claims of bodily injury, property damage, and personal injury.

- Professional Liability Insurance: Also known as Errors and Omissions Insurance, it protects professionals from claims of negligence or inadequate work.

- Product Liability Insurance: Shields businesses from claims related to the manufacturing or sale of products that cause harm or injury.

Scenarios Where Liability Insurance is Crucial

- Car Accidents: Liability insurance can cover medical bills and property damage if you are at fault in an accident.

- Slip and Fall Accidents: If someone is injured on your property, liability insurance can help cover medical expenses and legal fees.

- Professional Mistakes: For professionals like doctors or lawyers, professional liability insurance can provide protection in case of errors or omissions in their work.

Coverage Offered

Liability insurance provides protection against claims resulting from injuries and damage to people or property. It helps cover legal costs and settlements in case your business is sued for negligence.

General Liability Insurance vs. Professional Liability Insurance

General liability insurance typically covers claims related to bodily injury, property damage, and advertising injury. On the other hand, professional liability insurance, also known as errors and omissions insurance, protects against claims of professional negligence or failure to perform services adequately.

Limits and Exclusions

- Liability insurance policies have limits on the amount they will pay out per claim and per policy period. It’s crucial to understand these limits to ensure you have adequate coverage.

- Exclusions in liability insurance often include intentional acts, contractual liabilities, and certain types of professional services. Make sure to review these exclusions carefully to avoid any surprises when filing a claim.

Cost Factors

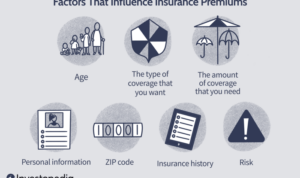

When it comes to the cost of liability insurance, there are several key factors that can influence how much you’ll pay for coverage. Understanding these factors can help you make informed decisions about your policy.

Factors Influencing Cost

- Industry Risk: Certain industries are considered more risky than others, which can impact the cost of liability insurance. For example, a construction company may pay more for coverage than a retail store.

- Business Size: The size of your business, including the number of employees and annual revenue, can also affect the cost of liability insurance. Larger businesses may pay more for coverage due to higher exposure to risk.

- Location: Where your business is located can impact your insurance costs. Businesses in areas prone to natural disasters or high crime rates may pay more for coverage.

Coverage Limits and Deductibles

- Coverage Limits: The amount of coverage you choose for your liability insurance policy can directly impact your premiums. Higher coverage limits typically result in higher premiums, as the insurer is taking on more risk.

- Deductibles: A deductible is the amount you’re responsible for paying out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premiums, but it also means you’ll pay more in the event of a claim.

Tips for Reducing Costs

- Shop Around: Get quotes from multiple insurance providers to compare prices and coverage options.

- Bundle Policies: Consider bundling your liability insurance with other types of coverage, like property insurance, to potentially save money on premiums.

- Implement Risk Management Strategies: Taking steps to reduce your business’s risk, such as implementing safety protocols or training programs, can help lower your insurance costs.

- Review and Update Your Policy Annually: As your business grows and changes, your insurance needs may evolve. Regularly reviewing your policy with your insurance agent can help ensure you have the right coverage at the best price.

Choosing the Right Policy

When it comes to selecting the right liability insurance policy, there are a few key steps to keep in mind to ensure you have the appropriate coverage for your needs.

Determining the Appropriate Amount of Coverage Needed

Before choosing a policy, it’s essential to assess your individual circumstances and determine the amount of coverage required to protect yourself adequately. Consider factors such as the nature of your business, the potential risks involved, and the assets you need to safeguard.

- Calculate your total assets and liabilities to establish a baseline for coverage.

- Assess the specific risks associated with your industry or business activities.

- Consult with an insurance agent or professional to help determine the appropriate coverage limits.

Selecting a Reputable Insurance Provider

Choosing a reliable insurance provider is crucial to ensure you receive quality service and support when you need it most. Here’s how you can select a reputable insurance provider:

- Research different insurance companies and compare their reputation, financial stability, and customer reviews.

- Check if the provider offers specialized liability insurance tailored to your industry or specific needs.

- Inquire about the claims process and customer support services to gauge the provider’s efficiency and reliability.

Reviewing Policy Terms and Conditions, Liability insurance guide

Before finalizing your decision, it’s essential to thoroughly review the terms and conditions of the policy to ensure you understand what is covered and what is not. Pay close attention to:

- Coverage limits and exclusions that may impact your ability to file a claim.

- Deductibles and premium rates to determine the cost of the policy over time.

- Additional benefits or optional coverages that may enhance your protection.

Filing a Claim: Liability Insurance Guide

When it comes to filing a liability insurance claim, there are specific steps you need to follow to ensure a smooth process. Here’s a breakdown of what you should do:

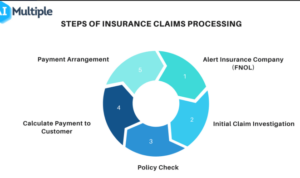

Steps Involved

- Contact your insurance provider as soon as possible to report the incident and initiate the claim process.

- Provide all necessary information, such as policy details, incident description, and any relevant documentation.

- Cooperate with the insurance company’s investigation and provide any additional information or documents they may request.

- Review and understand the terms of your policy to determine coverage and limits related to the claim.

- Wait for the insurance company to assess the claim, determine liability, and provide a resolution or compensation.

Tips for Documenting Incidents

- Take photos or videos of the scene and any damages or injuries resulting from the incident.

- Obtain contact information from witnesses and parties involved, including names, addresses, and phone numbers.

- Keep detailed records of any medical treatment, repairs, or other expenses related to the incident.

- Write down a detailed account of what happened, including the date, time, and circumstances leading up to the incident.

Common Pitfalls to Avoid

- Delaying the notification of the insurance company about the incident can lead to complications or denial of the claim.

- Providing inaccurate or incomplete information can hinder the claim process and result in delays.

- Failing to follow the terms and conditions of your policy can impact the outcome of the claim and coverage provided.

- Not seeking legal advice or assistance when needed for complex claims can lead to disputes or unfavorable resolutions.